All Categories

Featured

Table of Contents

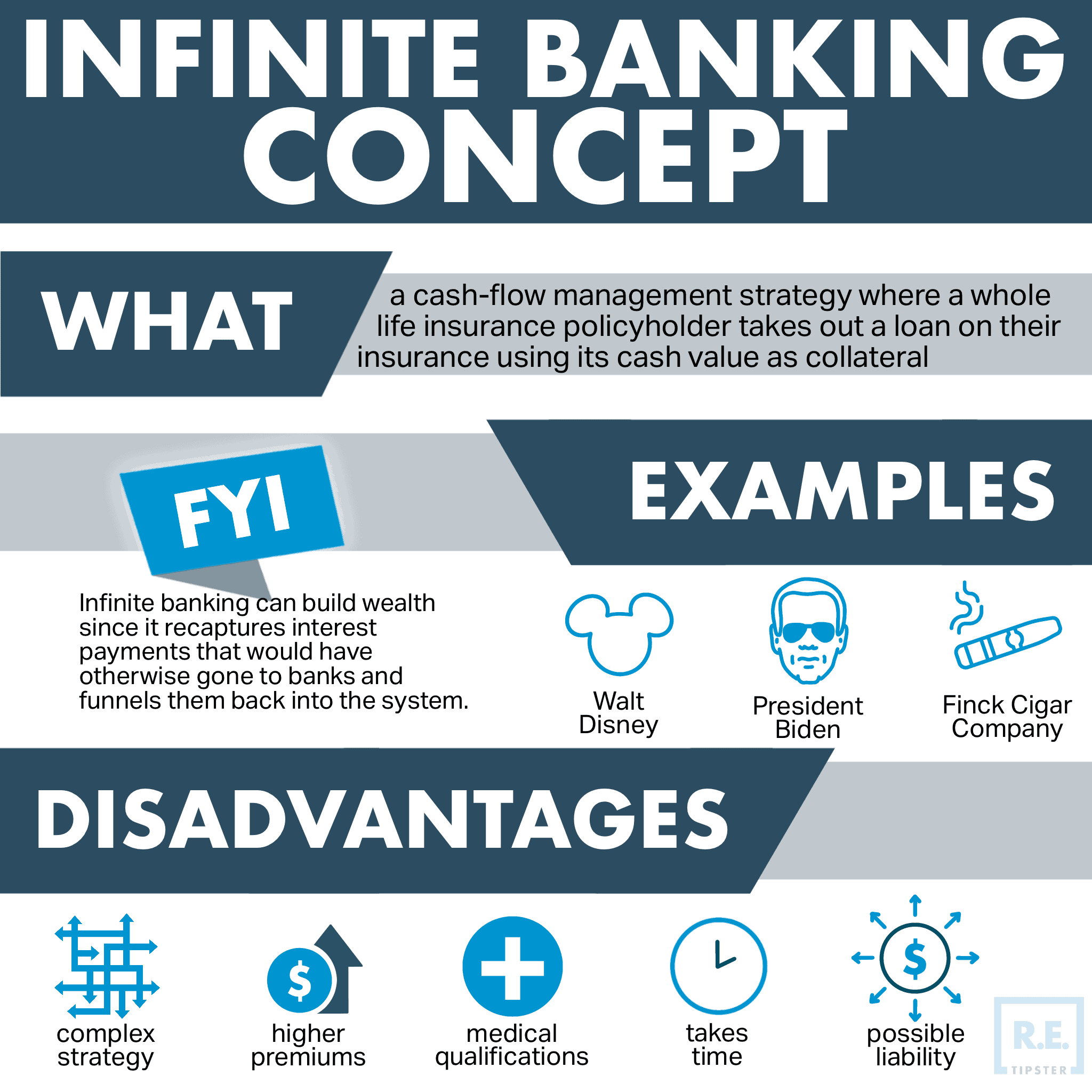

The are whole life insurance and universal life insurance policy. grows cash money value at a guaranteed interest price and additionally via non-guaranteed rewards. expands cash worth at a dealt with or variable rate, depending on the insurance company and policy terms. The cash money value is not included in the survivor benefit. Cash money value is a function you capitalize on while alive.

After ten years, the money value has actually grown to roughly $150,000. He obtains a tax-free car loan of $50,000 to begin a service with his sibling. The plan car loan rates of interest is 6%. He settles the loan over the next 5 years. Going this course, the interest he pays goes back right into his plan's cash value rather than a banks.

Becoming Your Own Bank

Nash was a money expert and fan of the Austrian school of business economics, which promotes that the worth of products aren't clearly the result of typical economic frameworks like supply and demand. Rather, people value money and items differently based on their financial standing and requirements.

Among the mistakes of standard banking, according to Nash, was high-interest rates on loans. Way too many individuals, himself consisted of, got involved in monetary difficulty due to reliance on financial organizations. As long as banks established the rates of interest and finance terms, individuals didn't have control over their own wide range. Becoming your own lender, Nash determined, would place you in control over your monetary future.

Infinite Financial requires you to have your financial future. For ambitious people, it can be the best monetary device ever. Below are the benefits of Infinite Financial: Probably the solitary most beneficial facet of Infinite Financial is that it enhances your cash flow.

Dividend-paying whole life insurance policy is really low threat and uses you, the insurance policy holder, a lot of control. The control that Infinite Financial supplies can best be organized into two categories: tax obligation advantages and asset securities - alliance bank visa infinite. Among the factors entire life insurance policy is ideal for Infinite Banking is exactly how it's strained.

Bioshock Infinite Vox Cipher Bank

When you utilize entire life insurance for Infinite Financial, you enter right into an exclusive contract in between you and your insurance coverage company. These defenses may differ from state to state, they can consist of protection from property searches and seizures, security from judgements and protection from financial institutions.

Whole life insurance coverage policies are non-correlated properties. This is why they work so well as the monetary foundation of Infinite Banking. Regardless of what takes place in the market (supply, actual estate, or otherwise), your insurance plan maintains its worth.

Market-based financial investments grow riches much quicker however are revealed to market changes, making them inherently dangerous. What if there were a 3rd bucket that used security but likewise moderate, guaranteed returns? Entire life insurance coverage is that 3rd container. Not just is the price of return on your entire life insurance plan ensured, your survivor benefit and costs are likewise ensured.

Here are its main advantages: Liquidity and access: Plan fundings give immediate accessibility to funds without the restrictions of traditional bank finances. Tax efficiency: The cash money value grows tax-deferred, and policy car loans are tax-free, making it a tax-efficient tool for building wide range.

Be Your Own Banker Whole Life Insurance

Property defense: In lots of states, the money worth of life insurance policy is shielded from creditors, adding an additional layer of financial protection. While Infinite Banking has its qualities, it isn't a one-size-fits-all service, and it includes substantial downsides. Below's why it might not be the most effective technique: Infinite Banking often calls for intricate plan structuring, which can puzzle insurance policy holders.

Visualize never ever having to stress over bank financings or high rates of interest again. What if you could obtain money on your terms and construct wealth concurrently? That's the power of infinite banking life insurance policy. By leveraging the money worth of entire life insurance policy IUL policies, you can grow your wealth and borrow money without relying upon conventional banks.

There's no set finance term, and you have the liberty to select the payment schedule, which can be as leisurely as repaying the car loan at the time of death. This versatility reaches the servicing of the fundings, where you can select interest-only repayments, keeping the finance balance flat and manageable.

Holding money in an IUL dealt with account being attributed rate of interest can often be much better than holding the money on down payment at a bank.: You've always dreamed of opening your own pastry shop. You can obtain from your IUL policy to cover the first expenses of renting a room, buying devices, and employing staff.

Non Direct Recognition Life Insurance

Personal car loans can be obtained from traditional banks and credit history unions. Obtaining cash on a credit card is usually extremely costly with annual portion rates of interest (APR) frequently reaching 20% to 30% or more a year.

The tax obligation treatment of policy finances can vary dramatically depending upon your nation of residence and the details terms of your IUL policy. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy loans are typically tax-free, providing a considerable advantage. Nevertheless, in various other jurisdictions, there may be tax obligation implications to take into consideration, such as prospective tax obligations on the financing.

Term life insurance only provides a death benefit, without any kind of cash money value buildup. This indicates there's no money worth to obtain versus.

For car loan policemans, the substantial regulations enforced by the CFPB can be seen as cumbersome and restrictive. Lending police officers often suggest that the CFPB's laws develop unnecessary red tape, leading to more documents and slower funding handling. Rules like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) demands, while targeted at securing consumers, can bring about delays in shutting bargains and increased functional expenses.

Table of Contents

Latest Posts

Private Banking Concepts

Become Your Own Bank. Infinite Banking

My Own Bank

More

Latest Posts

Private Banking Concepts

Become Your Own Bank. Infinite Banking

My Own Bank